Account Login

Make A Loan Payment

Make a loan payment with any Debit/Credit Card

Order Checks

Re-Order Checks

Online Applications

Complete your New Account or Loan Application anywhere!

Now Introducing Contactless Debit Cards

Bank of Dade is introducing Contactless Debit Cards to make your payment experience even better. With your Bank of Dade Contactless Debit Card you will be able to make payments with a simple tap of your card to the payment terminal.

Contactless transactions are a more secure way to pay. Your card never leaves your hand and each transaction is encrypted with a unique token code. Contactless transactions are far more secure than swiping your card or even using the chip.

Your new contactless debit card will replace your current card once it has expired. Any instant issue debit cards printed inside the bank will have the contactless feature as well.

moreMobile Banking App

Our Mobile App is getting a Fresh New Look! If you receive an error when trying to log in please uninstall and then reinstall the app from the Apple App Store or Google Play Store. If you have any issues please contact Bank of Dade.

moreDigital Wallets

Digital Wallets now available for your Bank of Dade Debit Card!

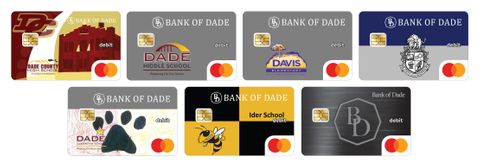

moreInstant Issue Debit Cards

Bank of Dade offers a wide range of debit card designs to choose from. Check out our Instant Issue Debit Card Designs and show your school spirit!

moreAccess account information anywhere, anytime with BRELLA

BRELLA can immediately alert you to potentially fraudulent activity for:

- A debit purchase for more than an amount you specify

- Any card-not-present debit transaction (i.e., phone, internet, mail)

- Any suspicious or high-risk transaction that occurs on your account

The newest feature is transaction control. With the quick tap of a button you’ll be able to block or unblock your card, without affecting previous transactions, if your card is stolen, goes missing or you just want to pause it while traveling. This feature not only provides you peace of mind, but also saves you the hassle associated with losing a card. Simply block your card until you find it, then unblock it for instant use. Users can also set up transaction level blocks for transactions over a specific dollar amount, internet and phone transactions and transactions outside the U.S. This fast and simple security feature takes fraud safety up a notch.

Download BRELLA today on the Apple® App Store® or Google Play™ and follow the instructions.

moreNow Introducing Contactless Debit Cards

Bank of Dade is introducing Contactless Debit Cards to make your payment experience even better. With your Bank of Dade Contactless Debit Card you will be able to make payments with a simple tap of your card to the payment terminal.

Contactless transactions are a more secure way to pay. Your card never leaves your hand and each transaction is encrypted with a unique token code. Contactless transactions are far more secure than swiping...

moreFree Community Shred Day

Bank of Dade will be sponsoring a Free Community Shred Day. Help keep your identity safe by shredding your confidential documents.

moreICBA - Be Heard. Grassroots Action Center

Let your representatives know you support community banks.

CLICK HERE to visit ICBA's Grassroots Action Center.

About External Links

We may provide links to third party sites not controlled by Bank of Dade. If you follow links to sites not affiliated or controlled by Bank of Dade, we encourage you to read the privacy policies and terms of use of...

moreTax Information Reporting Proposal

CLICK HERE for a statement from the American Bankers Association regarding the Tax Information Proposal currently being discussed.

About External Links

We may provide links to third party sites not controlled by Bank of Dade. If you follow...

moreMobile Banking App

Our Mobile App is getting a Fresh New Look! If you receive an error when trying to log in please uninstall and then reinstall the app from the Apple App Store or Google Play Store. If you have any issues please contact Bank of Dade.

moreApp Store & Google Play Store

Download our Mobile App on the App Store or Google Play Store

moreMobile Deposit Capture

Mobile Deposit Capture is Here!

Take your banking on the go with Bank of Dade’s Mobile Banking App with Mobile Deposit Capture for your smart phone.

What is Bank of Dade Mobile Deposit Capture?

Mobile Deposit Capture allows you to use your smart phone to take a picture of a check and deposit it into one of your accounts that are linked to your Internet Banking.

...

more